Powering secure, compliant KYC and AML identity verification with AI-driven automation, & customizable workflows.

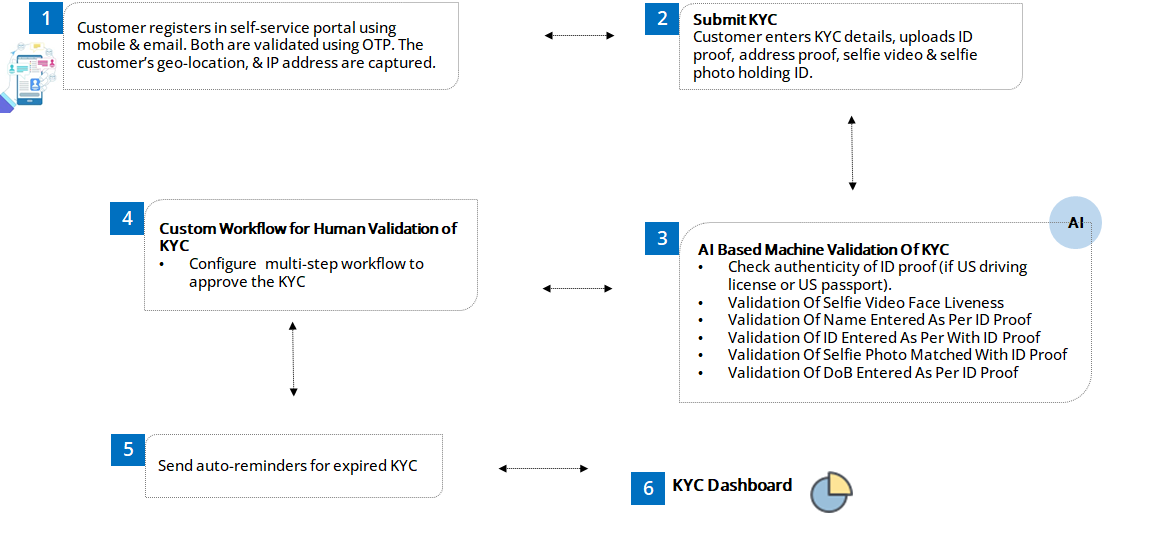

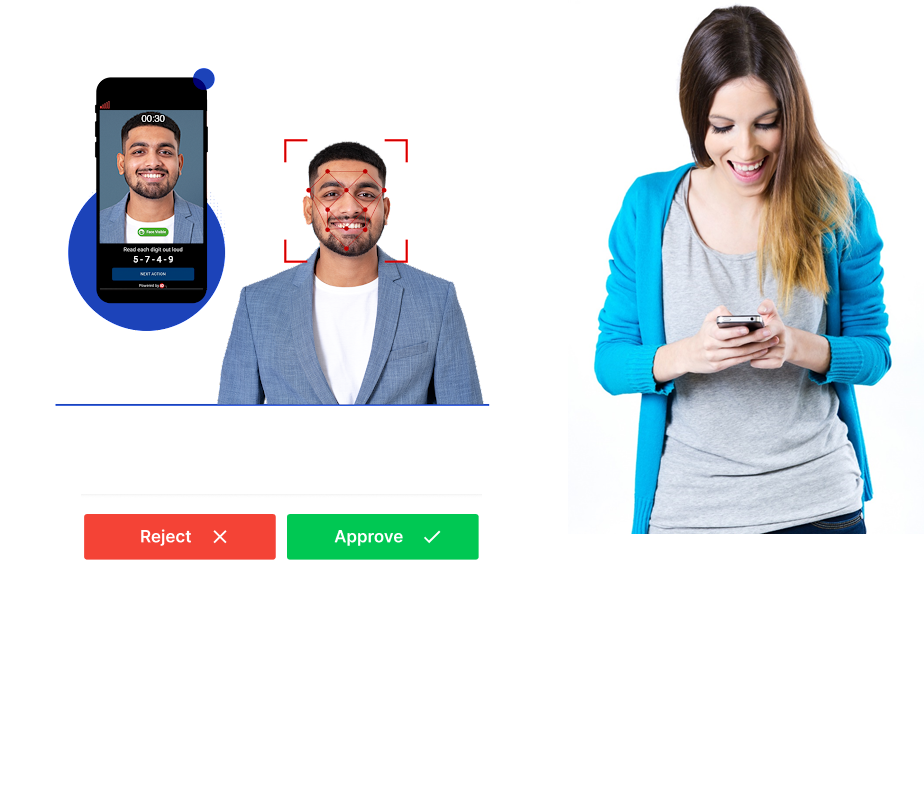

By combining AI-driven identity verification technologies - such as real-time face matching, biometric liveness detection, and global ID card verification - with customizable workflows and human oversight, businesses can achieve a powerful balance between automation and accuracy.

This hybrid approach enables faster, more secure onboarding, reducing fraud and ensuring compliance with KYC and AML regulations.

Customizable workflows allow businesses to tailor verification processes to specific needs, while human double-checks add an extra layer of assurance where necessary.

The result is reduced operational costs, increased customer trust, and improved ROI through enhanced efficiency and fraud prevention.

How it Works

Demo

Business Impact

Faster Customer Onboarding

Accelerate onboarding with automated real-time verification, boosting conversion rates.

Improved Regulatory Compliance

Ensure compliance with KYC, AML, and global identity regulations efficiently.

Reduced Fraud Losses

Minimize fraudulent transactions and chargebacks with AI-driven identity verification.

Enhanced Customer Trust

Build customer confidence with secure, seamless, and reliable identity verification processes.

Lower Operational Costs

Automate identity verification, reducing manual intervention and associated labor costs.

Features

Liveness Detection

Ensure the user is physically present, preventing deepfakes or spoofing.

AI-Driven ID Card Verification

Automatically authenticate ID documents using AI for accurate validation.

OCR Data Extraction

Quickly extract data from ID documents using high-accuracy OCR.

Document Upload

Upload identity and verification documents securely.

Address Verification

Verify addresses using geolocation or document proof.

AML Screening

Screen users against anti-money laundering databases.

Custom Approval Workflows

Streamline identity verification process with custom automated workflows.

Real-Time Validation

Validate data instantly against government databases.

Audit Trail

Track all KYC steps for regulatory compliance.

User Consent Management

Capture and store user consent during KYC process.

Automated Reminders

Automatically send renewal reminders for expired KYC.

Face Match with ID Photo

Compare the user's live face with their ID photo to confirm identity.