AI-powered secure identity verification with automated workflows.

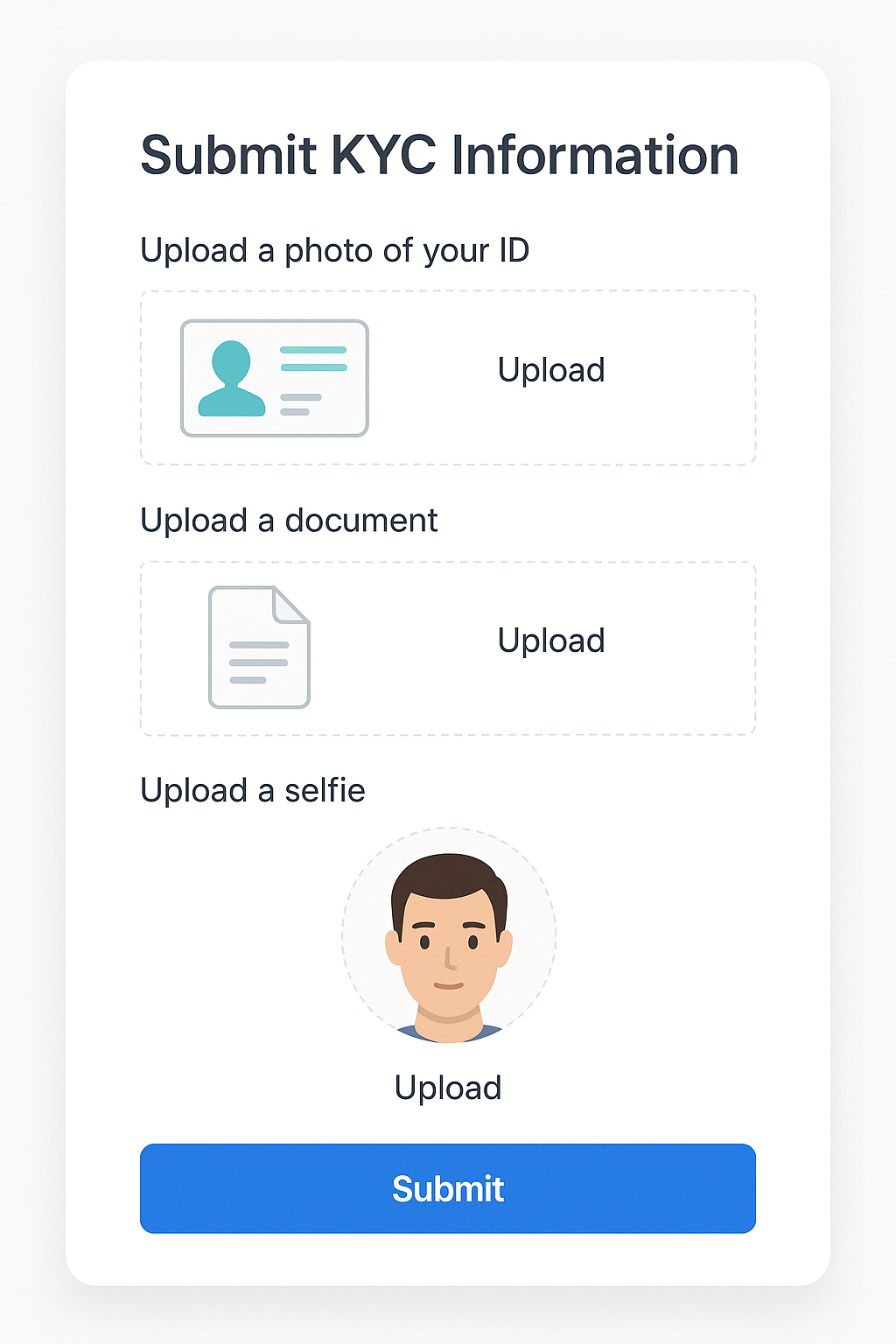

RoundInfinity’s KYC module automates identity verification through a secure, AI-driven process. Customers can complete onboarding by uploading ID documents, taking a selfie, and confirming personal details - all from their mobile or web portal. AI validates document authenticity, matches selfies with ID photos, and detects face liveness to prevent fraud.

Integrated with workflow automation, the system routes verified users for approval or further checks, logs every step for audit purposes, and ensures compliance with regulatory standards - without slowing down the experience.

KYC Workflow Initiation

Customers are prompted to complete KYC as part of onboarding, registration, or document verification workflows.

US ID Document Upload & Validation

AI extracts and validates user data from uploaded government-issued IDs (e.g., driver’s license, passport) in real time.

Selfie Capture & Face Match

Users are prompted to take a selfie, which is automatically matched against the ID photo using facial recognition.

Face Liveness Detection

AI checks for face liveness to confirm the person is physically present - preventing spoofing or deepfake attempts.

Data Extraction & Validation

Key fields like name, DOB, address, and document number are extracted and validated against input or existing records.

Automated Decisioning

If the KYC check is successful, the system proceeds to approve or escalate the case based on configurable rules.

Audit Trail & Compliance Logs

Each verification step is logged with timestamps and status updates to meet compliance and audit requirements.

Mobile & Web Accessibility

The entire process is optimized for mobile and desktop use, ensuring convenience and high completion rates.

Workflow Integration

KYC outcomes can trigger follow-up actions - granting access, enabling payments, or flagging cases for manual review.

Secure Storage & Encryption

User documents and biometric data are stored with encryption and access controls to ensure regulatory compliance (e.g., GDPR, SOC 2).